“The time when electric vehicles were a premium product that was only bought by a small target group is slowly coming to an end.”

The shift towards e-mobility is in full swing and car manufacturers are recording a strong increase in sales figures for electric vehicles. In the first part of this two-part interview, our consultant Tobias Grün tells us what influence this has on the sales sector and where customers will be found in the future.

Sales of e-vehicles have risen sharply and there is a great deal of attention surrounding the topic of electromobility - both within the automotive industry and in society. What influence does e-mobility have in your work as a consultant? What questions arise in particular?

There is no doubt that this is a highly topical issue for manufacturers and no longer a topic of the future. Electromobility is increasingly being incorporated in manufacturers’ portfolios or is being expanded, and volume planning with significant unit numbers has been decided for the coming years. For manufacturers, we can of course now look at this from two perspectives: What does this mean from a sales perspective and what does it mean from a service perspective?

Okay, let’s start with the sales perspective. What are the challenges here?

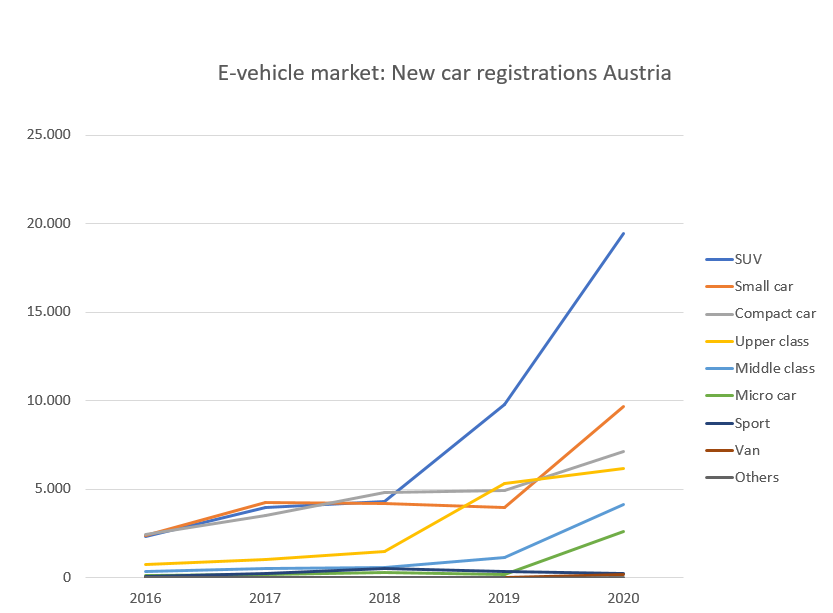

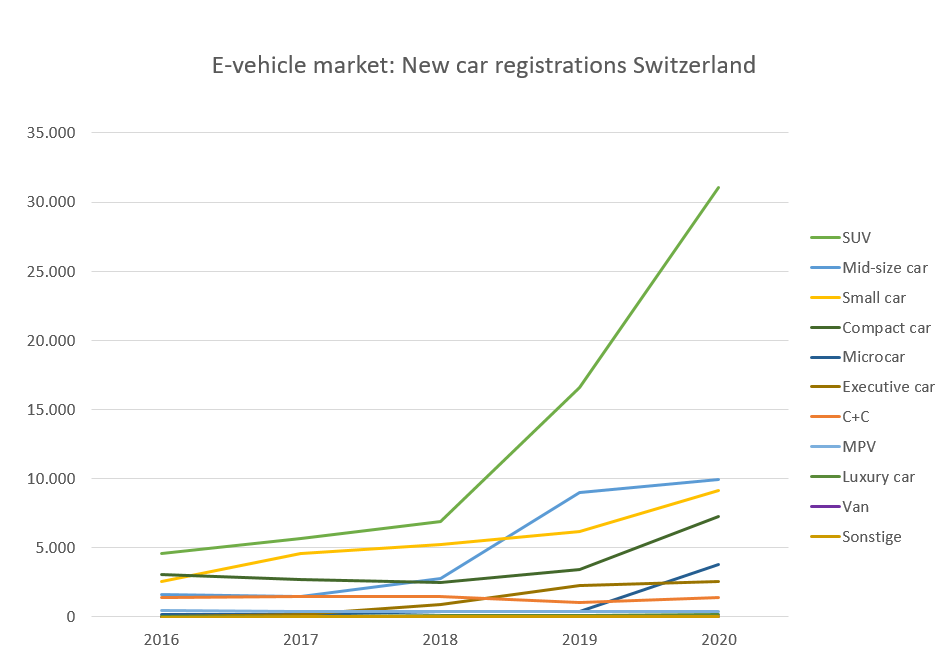

From a sales perspective, as a trending topic, it is above all a marketing topic. The vehicles have to be marketed but de facto they come onto the market as a replacement for established vehicles. They don’t come as a niche product or as an addition to the portfolio, but as a replacement for other vehicles. This means that the impact on sales in some sectors is not that great. This will also level out over the coming years, with the result that the sales potential will essentially be found in the same places where it can already be found today.

Can you elaborate on that?

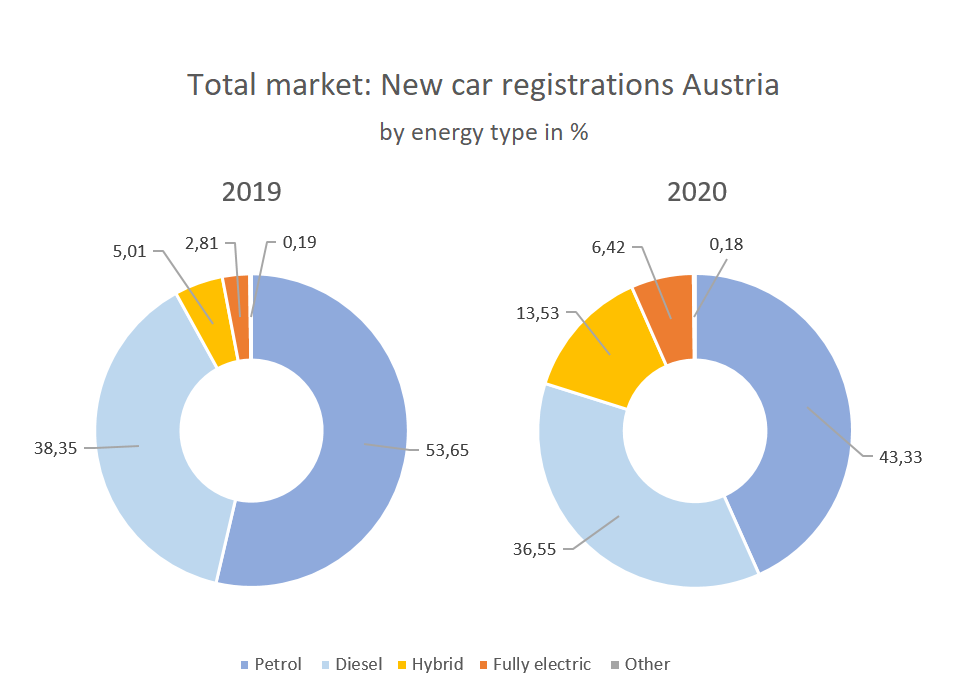

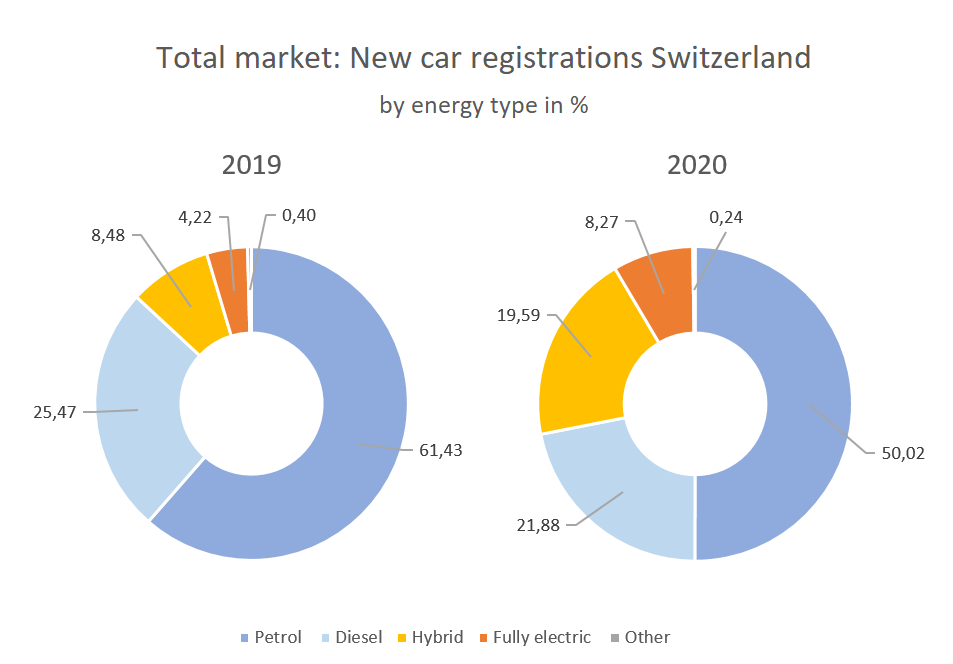

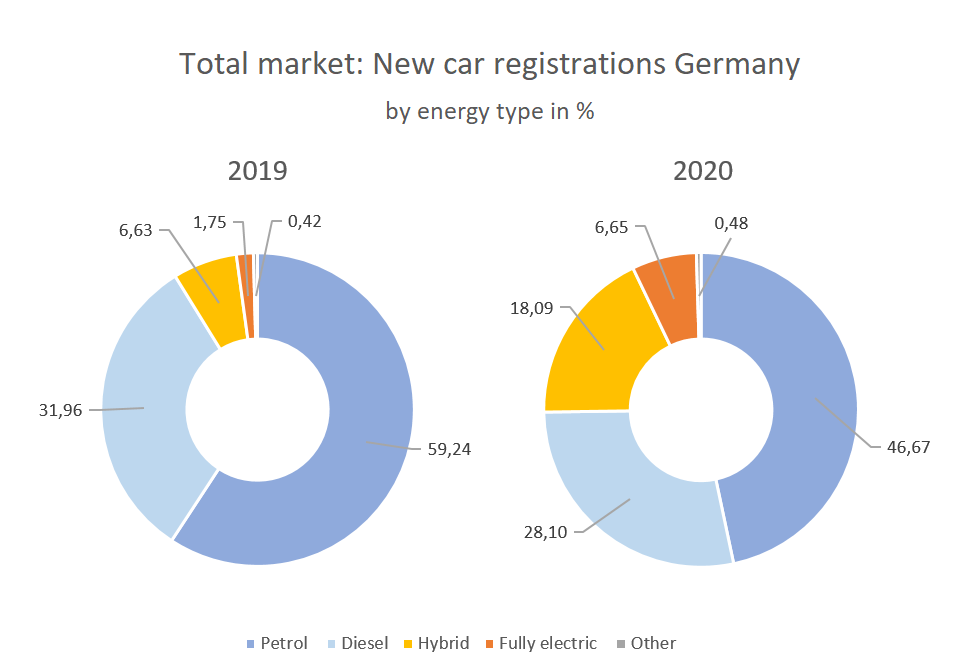

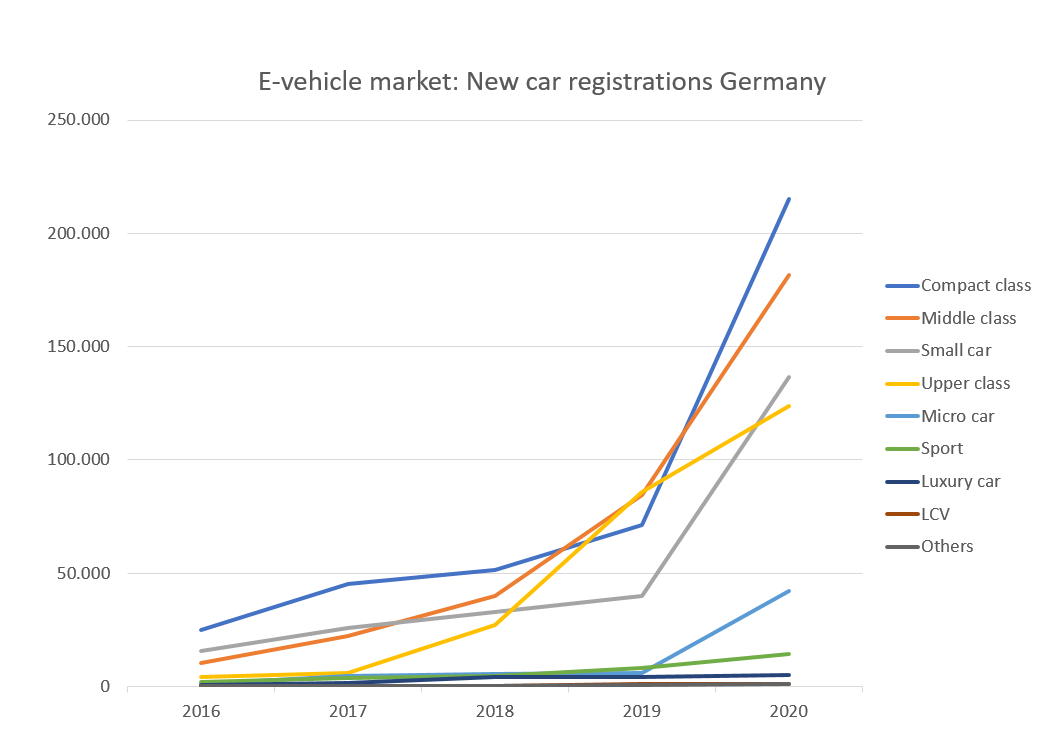

Well, the time when electric vehicles were a premium product that was only bought by a small target group is slowly coming to an end. In the early days, there were only a few manufacturers that had electric vehicles in their portfolio at all. Production capacities were smaller, unit numbers lower and development costs high. Therefore, it wasn’t possible to serve a price-sensitive market at first. In other words, the vehicles were developed for a niche of well-off people and sold where people already lived with premium combustion engine vehicles. However, this niche has long since been abandoned, on the one hand because these manufacturers offer electric motors for several - even smaller and cheaper - models, and on the other hand because more manufacturers in general have jumped on this bandwagon. The fact is that numerous manufacturers have now entered the mass market.

April 2021

Data source: Germany, Kraftfahrt-Bundesamt, Registrations, 15.03.2021, Data license by-2-0; Management Services Helwig Schmitt GmbH

Tobias’ outlook on the service perspective and his recommendations for dealing with e-mobility for sales, service and network planning can be found in the second part of the interview.

A good strategy requires the right basis for data. As a long-standing partner of the automotive industry, we offer you support for your network development by providing consulting and a powerful network planning system. Learn more about our services in the field of "Network Development" or contact us directly.